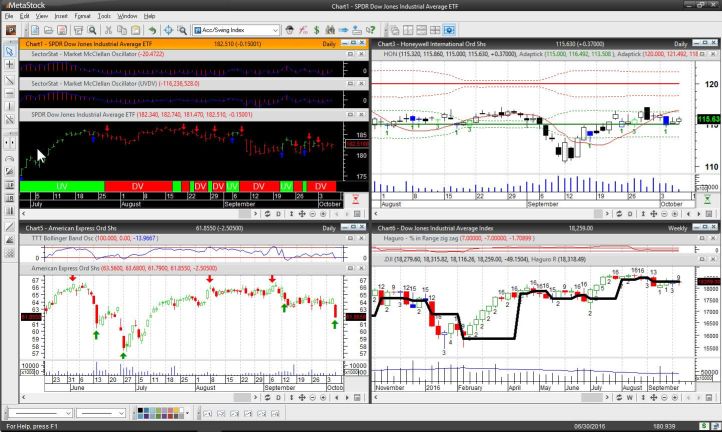

Metastock 17 End Of Day

395 euro + VAT

Including long time series of over 40 years and 1 month data service.

The software requires payment of an annual fee of 12 euros.

Among the specialized technical analysis programs developed for computers, Metastock is certainly one of the best in the world. It is the software that has received the highest number of special awards and is the most mentioned in newspapers and stock exchange news magazines.

Metastock is the winner as best analysis software of the prestigious Stocks & Commodities Award in the years 1993, 1994, 1995, 1996, 1997, 1998, 1999, 2000, 2001, 2002, 2003, 2004, 2005, 2006, 2007, 2008, 2009, 2010, 2011, 2013. 2014, 2015 e 2016.

Click here for a video presentation with the news of Metastock 17.

1 System Requirements

Operating System: Microsoft Windows 10, Windows 8, Windows 8.1, Windows 7 and Apple MAC (with Windows and Boot Camp installed)

Minimum processor: 800 megahertz (MHz)

Minimum RAM: 512 MB

Video: Video card with at least 256 colors and 1021×768

Disk space: 200 to 800 Mb free

2 General features

The interface and menus are the standard Windows interface and menus to help make it easier to use. The localization of menus, buttons, controls and masks is the same used by Microsoft Office (Word, Excel, Powerpoint and Access).

Metastock includes:

New Downloader – allows you to enter and edit data (for manual updates)

Export Advisor – Tools that allows the creation of automatic trading systems (trading system), with visual and audible alarms.

System Tester – tests virtually all trading systems doing the so-called backtesting, allowing optimizations and comparisons for maximum profitability. Including the possibility to use stop loss and take profit.

The Explorer – this feature allows you to automatically filter and analyze tens of thousands of instruments. The filter can be configured as desired, e.g. overbought/oversold securities, securities with certain loss/gain losses, etc… This simplifies and speeds up the analysis and search for tools.

Indicator Builder – gives the possibility for the most advanced traders to create their own indicators by inserting and editing the formulas in the Metastock programming language.

Forecaster Time Frames – allows the use of already configured algorithms, predictions of the price trend.

Elliott Wave System – Based on the legendary work of Ralph Nelson Elliott, the Metastock Elliott Waves System gives you the ability to chart high, medium and low waves. Formally a Metastock add-on, this version comes standard free of charge.

Special K Systems from Mertin Pring – This version of Metastock includes as standard the add-on with Martin Pring’s proven K systems, which allow you to identify short, medium and long term market cycles, identifying peaks and troughs and points, with bullish or bearish market turning points.

RMO Oscillator – Rahul Moihndar’s Rahul Oscillator is one of the most widely used oscillators by both experienced and novice traders. It is a very powerful strategy that helps traders identify opportunities when aligning short, medium and long trends. With this Expert Advisor based on the legendary RMO indicator you can identify bullish or bearish market configurations.

Option Scope – NEW – this module is designed to specifically analyze option quotes, displaying prices, charts and Greek (additional paid module).

Offline mode – allows operation even when there is no internet connection.

Favorites

You can create various custom signs with your favorite titles.

Fibonacci

Metastock includes an advanced version of Fibonacci analysis techniques. It is possible to visualize projections and tracing used by the famous stock analysis technique.

Indicators

The list of indicators includes 250 predefined indicators, more than any other program:

Accumulation/Distribution, Accumulation Swing Index, Adaptive Aroon, Adaptive Average Directional Movement, Adaptive Average Directional Movement, Adaptive Average True Range, Adaptive CCI, Adaptive Chaikin Money Flow , Adaptive Chande Momentum Oscillator, Advance Decline Line, Adaptive Detrended Price Oscillator, Adaptive Directional Movement +/- DI, Adaptive Directional Movement Index, Adaptive Directional Movement Rating, Adaptive Ease of Movement, Adaptive Inertia, Adaptive Intraday Momentum Index, Adaptive Linear Regression Indicator, Adaptive Linear Regression Slope, Adaptive MACD, Adaptive Mass Index, Adaptive Mesa Sine Wave, Adaptive Money Flow Index, Adaptive Moving Average, Adaptive Moving Average Exponential, Adaptive Moving Average Simple, Adaptive Moving Average Weighted, Adaptive Polarized Fractal Effiency, Adaptive Price Oscillator, Adaptive Price Rate-of-Change, Adaptive Projection Bands, Adaptive Projection Oscillator, Adaptive QStick, Adaptive Range Indicator, Adaptive Relative Momentum Index, Adaptive Relative Strength Index, Adaptive Relative Volatility Index, Adaptive r-Squared, Adaptive Standard Deviation, Adaptive Standard Error, Adaptive TEMA, Adaptive Time Series Forecast, Adaptive TRIX, Adaptive Ultimate Oscillator, Adaptive Vertical Horizontal Filter, Adaptive Volatility Chaikin’s, Adaptive Volume Oscillator, Adaptive Wilder’s Smoothing, Adaptive Williams’ R, Alpha, Andrews’ Pitchfork, Arms Index (TRIN), Aroon, Average True Range, Beta, Binary Wave, Bollinger Bands, Bull Power Bear Power 1, Bull Power Bear Power 2, Bull Power Bear Power 3, CCI (Commodity Channel Index), Chaikin A/D Oscillator, Chaikin Money Flow, Chaikin Volatility, Chande Forecast Oscillator, Chande Momentum Oscillator, Chandelier Stops, CMO Reversal Commodity, Channel Index, Commodity Selection Index, Consolidation Breakout, Cooper 1234 Pattern, Coppock Curve, Correlation Analysis, Cycle Lines, Cycle Progression, Darvas Box, Dema Demand Index, Denvelopes, Detrended Price Oscillator, Directional Movement, Donchian Channels, Dynamic Momentum Index, Dynamic Momentum Index 1, Ease of Movement, Elder Ray, Ellipse, Envelope, Equidistant Channel Line, Exponential Moving Average, Fibonacci Arcs, Fibonacci Fans, Fibonacci Retracements, Fibonacci Time Zones, Fisher Transformation Indicator, Forecast Oscillator, Fourier Transform, Fractal Trading System 1, Fractal Trading System 2, Gann Angles, Gann Fans, Gann Grids, Gann Line, Gann Swing Bands, Herrick Payoff, Index Horizontal Line, Ichimoku, Kinko, IntelliStops, Intraday Momentum, Inverse Fisher Transform of RSI, Klinger Oscillator, Linear Regression, Linear Regression Lines, Linear Regression Slope, Long Sell Short Sale – 5 Day MACD (2), MACD Histogram 1, MACD Histogram 2, Market Facilitation Index, McClellan Oscillator, McClellan Summation Index, Meisels Overbought/Oversold Median Price, MESA Sine Wave, Momentum, Money Flow Index, Moving Average – Simple, Moving Average – Exponential MovingAverage – Weighted, Moving Average – Time Series Moving Average – Triangular, Moving Average – Ribbon, Moving Average – Variable, Moving Average – Volume Adjusted, Natenberg’s Volatility (Daily), Negative Volume Index, Odds Probability Cones, On Balance Volume, Open Interest, Option Delta, Option Expiration, Option Gamma, Option Life, Option Price, Option Theta, Option Vega, Option Volatility, Parabolic SAR, Pattern Trading System 1, Percent Retracement, Percentage Crossover 3, Performance Polarized Fractal Efficiency, Positive Volume Index, Price Oscillator, Pring KST, Projection Price Bands Channel, Projection Oscillator, Projection Oscillator 1, Qstick Quadrant Lines, r-squared, Raff, Regression Channel, Rainbow Band Upper, Rainbow Band Lower, Rainbow Max, Rainbow Min, Rainbow Oscillator, Random Walk Index, Range Indicator, Rectangle, Relative Momentum Index, Relative Performance, Relative Strength Index, Relative Volatility Index, Semi-Log, Trendline, Sine Wave 5-unit, Standing, Speed Resistance Lines, Spread, Standard Deviation, Standard Error, StochRSI, Stochastic Momentum Index, Stochastic Oscillator, Stochastic, RSI, Squat Bar, Swing Index, Tema, The Force Index, Time Series Forecast, Tirone Levels, Trade Volume Index, Trendlines, Trendline by Angle, TRIX, Turtle, Trader Bands, Typical Price, Ultimate Oscillator, Vertical Horizontal Filter, Vertical Line, Volatility Breakout (Chaikin), Volatility Indicators, Volume, Volume Oscillator, Volume Rate of Change, Weighted Close, Wilder’s Smoothing, Williams’ A/D %R, Zig Zag.