Elwave 10 Full (automatic trading signals)

1695 + VAT

The full version of Elwave has all the features and functions indicated in the description of the Intraday and Eod version, but in addition it has the following important modules:

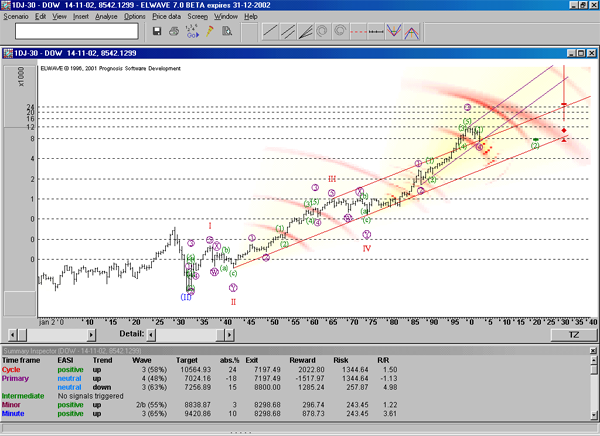

Automatic analysis module.

Together with the trading signals, the automatic analysis module is the heart of the software. It does exactly what you want it to do. It examines all price data fully automatically according to Elliott’s wave principle, so that it does not obstruct the complexity of this methodology.

ELWAVE is considered the best analysis software on the market for Elliott waves. Why? Because of its precision in detail analysis and speed. And, above all, because of its clear presentation of signals at different times. Short or long term, depending on the time you are looking at.

For advanced users, it is possible to analyze each passage of the wave in the graph even deeper, but this option is probably not necessary. You can also use your number as a starting point for automatic analysis or have Elwave analyze a specific section of the graph. What’s more, it’s the only Elliott Wave software that tells you exactly why a particular wave count is preferred, comparing the scores of the alternatives and showing all the rules that apply.

It comes with two different sets of rules, modern and classic. The rules define classic models in the way Elliott has used them, while modern rules incorporate the latest and most extensive search for newer models, but always based on fundamentals, as defined by Elliott.

Another important difference is that modern rules generate more aggressive signals and present a real opportunity for trading.

Trading signals and target module.

The module displays trading signals in a window. Trading opportunities are listed in the window indicating a specific input and expected output levels, which are different for each wave model.

At the same time and with the same method, the stops and are indicated for each model wave in the trading signals window.

The critical break levels will then be displayed and, if necessary, the analysis will be updated automatically.

If a real-time data source is activated, ELWAVE automatically checks the input signals and updates the analysis if the critical break levels have been breached.

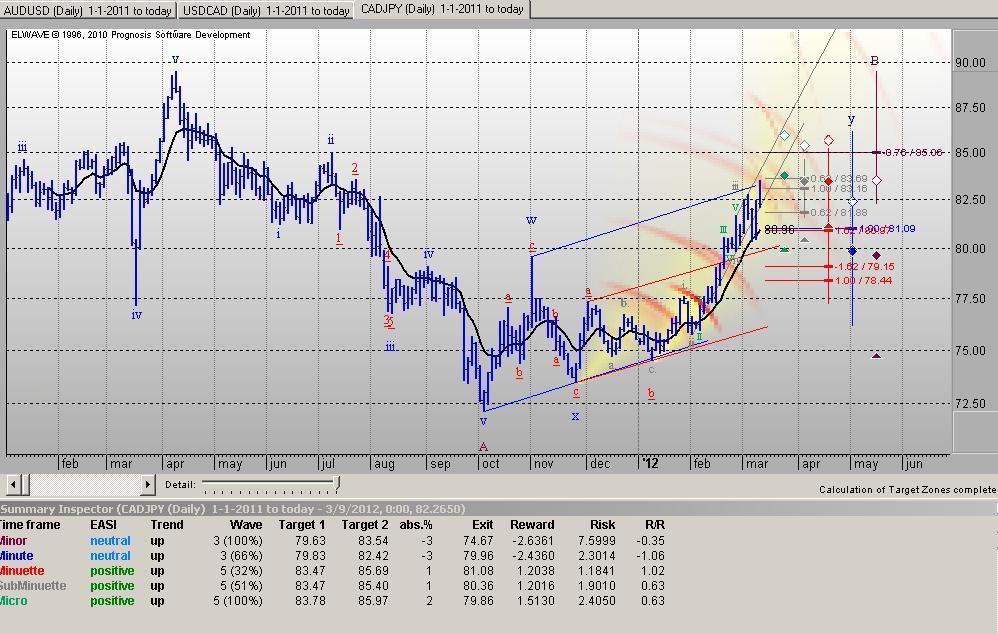

The intervention sectors combine Fibonacci and price targets in combination with wave counts to predict price movements in the future.

An indicator projects sensitive time periods when significant reversals are most likely. When the different periods are grouped very close to a specific date, the greater the likelihood that the market is reversed by significant resistance at the top or bottom. This is an interesting research tool to determine when significant changes can occur.

Exploration Module.

Allows you to Scan all markets to find the best trading opportunities with Elliott’s Waves fully automatically.

ELWAVE combines Elliott’s wave analysis with all its power. This exciting new software can search for specific configurations of Elliott’s waves. d example, you can search only for stocks with a positive trend or only the one that presents “a wave 3 wave 3” within a bullish trend.

With this awesome power in hand they can find the odds or titles that are expected to head up or down with a strong upward or downward acceleration.

This is exactly what the scan module will do, and fully automatically.